To celebrate World Tourism Day Mara Elephant Project wanted to highlight a recent report produced by the World Economic Forum called The Travel & Tourism Competitiveness Report 2017. Tourism is a key component of conservation for one cannot exist without the other. The most significant finding, as it relates to MEP, is that keeping a pristine ecosystem has a direct impact on the revenue generated from tourism. Here are some of the key points of the study.

The Travel & Tourism Competitiveness Report 2017

In the past decades travel & tourism and its enabling ecosystem have proven to be significant drivers of economic growth, contributing over 10% to global GDP and accounting for 1 in 10 jobs on the planet. The industry continues to be a force for good, providing unique opportunities for developing and emerging nations to move up the value chain.

The theme of this seventh edition of the Travel & Tourism Competitiveness Report 2017: Paving the Way for a More Sustainable & Inclusive Future, highlights the increasing focus on ensuring the industry’s sustained growth in an uncertain security environment while preserving the natural environment and local communities on which it so richly depends. The goal of achieving a sustainable and inclusive travel & tourism industry is not new, and the industry has been proactive in its commitment to set targets. Yet, in light of the rise of sustainability on the global agenda through summits in Addis Ababa, New York and Paris, the industry must continue to strive to be a leader in addressing inclusiveness and sustainability both responsively and responsibly. Solutions will need to be both global and local, while ensuring full societal inclusion. The theme highlights the travel and tourism industry’s commitment to be a force for good in an era marked by jobless growth, growing concerns of a “green-less” future and mounting fears of isolationism and nativism. With a forecasted 1.8 billion international tourists by 2030, the industry has the potential to play a key role in creating high-quality employment opportunities, act as a vehicle to protect and restore our planet’s biodiversity and help build bridges between people and cultures.

In 2017, the travel & tourism industry continues to make a real difference to the lives of millions of people by driving growth, creating jobs, reducing poverty and fostering development and tolerance. For the sixth consecutive year, industry growth outperforms that of the global economy, showcasing the industry’s resilience in the face of global geopolitical uncertainty and economic volatility. The industry contributed US$7.6 trillion to the global economy (10.2% of global GDP) and generated 292 million jobs (1 in 10 jobs on the planet) in 2016. International arrivals followed suit, reaching 1.2 billion in 2016, 46 million more than in 2015. These promising figures are expected to continue increasing in the coming decade.

Research shows that for every 30 new tourists to a destination one new job is created; and already today, the travel and tourism industry has almost twice as many women employers as other sectors. Accounting for 30% of world services exports, and the largest export category in many developing countries, the industry is a tremendous employment generator. Yet research suggests that the industry’s potential could be hindered—and 14 million jobs could be at risk—if governments and the private sector do not address the talent shortage in the industry. If properly managed, the T&T sector can continue to be a contributor to inclusive growth, given the relatively low barriers required to provide services and start a business related to tourism.

Additionally, the sector is making large strides toward a larger focus on environmental sustainability. Since the 1980s, air traffic has doubled every 15 years—a trend that is expected to continue. In 2016, nearly 4 billion people travelled by plane, a number expected to reach 7.2 billion by 2035. As such, resource efficiency, environmental protection and climate change are central to the industry’s agenda and part of its triple bottom line. Further, sustainability has accelerated as a policy issue in the past decade as the planet remains under threat of existential climate change—and industry leaders have followed suit to set ambitious targets. They aim to move beyond carbon-neutral growth and, by 2050, halve net CO2 emissions compared to the 2005 baseline. At the same time, revenue generated through tourism is both an important incentive and a source of funding to protect the natural environment.

At the core of the Report is the seventh edition of the Travel & Tourism Competitiveness Index (TTCI). The aim of the TTCI, which covers 136 economies this year, is to provide a comprehensive strategic tool for measuring the set of factors and policies that enable the sustainable development of the travel & tourism sector, which in turn, contributes to the development and competitiveness of a country. By providing detailed assessments of the T&T environments of countries worldwide, the results can be used by all stakeholders to work together to improve the industry’s competitiveness in their national economies. It also allows countries to track their progress over time in the various areas measured.

The Travel & Tourism Competitiveness Report 2017 contains detailed profiles for each of the 136 economies featured in the study, as well as an extensive section of data tables with global rankings covering the 90 indicators included in the TTCI. In addition, it includes insightful contributions from a number of industry leaders.

The Report not only provides a platform for multi-stakeholder dialogue at the country level to formulate appropriate policies and actions. It also takes a global approach through the analysis of industry trends and offers the unique perspectives of global leaders from industry, international organizations and government on critical issues to address to ensure the long- term travel & tourism competitiveness.

Four key findings emerge from the results of the 2017 TTCI in combination with other quantitative and qualitative analysis:

- First, T&T competitiveness is improving, especially in developing countries, and particularly in the Asia-Pacific region. As the industry continues to grow, an increasing share of international visitors are coming from and travel to emerging and developing nations.

- Second, in an increasingly protectionist context—one that is hindering global trade—the T&T industry continues building bridges rather than walls between people, as made apparent by increasing numbers of people travelling across borders and global trends toward adopting less restrictive visa policies.

- Third, in light of the Fourth Industrial Revolution, connectivity has increasingly become a must-have for countries as they develop their digital strategy.

- Finally, despite the growing awareness of the importance of the environment, the T&T sector faces the difficulties to develop sustainably as natural degradation proceeds on a number of fronts.

MEP is especially interested in the fourth finding as highlighted in a recent New York Times piece Loss of Fertile Land Fuels “Looming Crisis” Across Africa. We are fighting a war of space in the Mara, wildlife habitats are being threatened as the population grows and fertile land decreases and not enough is set aside to ensure the keystone species, like elephants, can survive. This directly impacts the tourism industry for Kenya and thus a key component for the economy.

The growing expanse of farmland in the Mara.

MEP believes that securing an environment in which elephants are safe is critical. Efforts to influence spatial strategies and migration corridors and affect the National and County Elephant Strategy are a part of MEP’s sustainability plan. Similarly, the approach towards building community support for the goals and vision of MEP are aimed at changing attitudes within tourism and hence behaviour towards elephants which will result in a longer term secure environment.

One of the key areas for sustainability that MEP is focusing on is the purchase of parcels of land containing critical habitat, placing this in public trust and leasing them to the conservancies. MEP understands the clear linkage between better protecting the conservancies and keeping the elephants on the conservancy areas. The largest threat to elephants inside the conservancies is access to food resources. Many of the conservancies open their areas for community grazing during certain periods of the year. This has a dramatic effect on the availability of grass forcing the elephants to wonder into community areas in the search for food. Through a grant of $300,000 provided by a generous donor, MEP is working with the conservancies to both communicate this message though collar data and HEC data but also help them to develop livestock management plans, move settlements from inside the conservancies, and better police their natural resources for elephants.

Despite growing global awareness of the importance of sustainability, and the fact that real progress has been made on some fronts, many aspects of the natural environment continue to degrade, causing a serious and quantifiable impact on the tourism sector. Though countries are increasingly committed to respecting international environmental standards, environmental performance benchmarking assessments show that deforestation, over fishing, and air and water pollution continue to reduce the global natural capital.

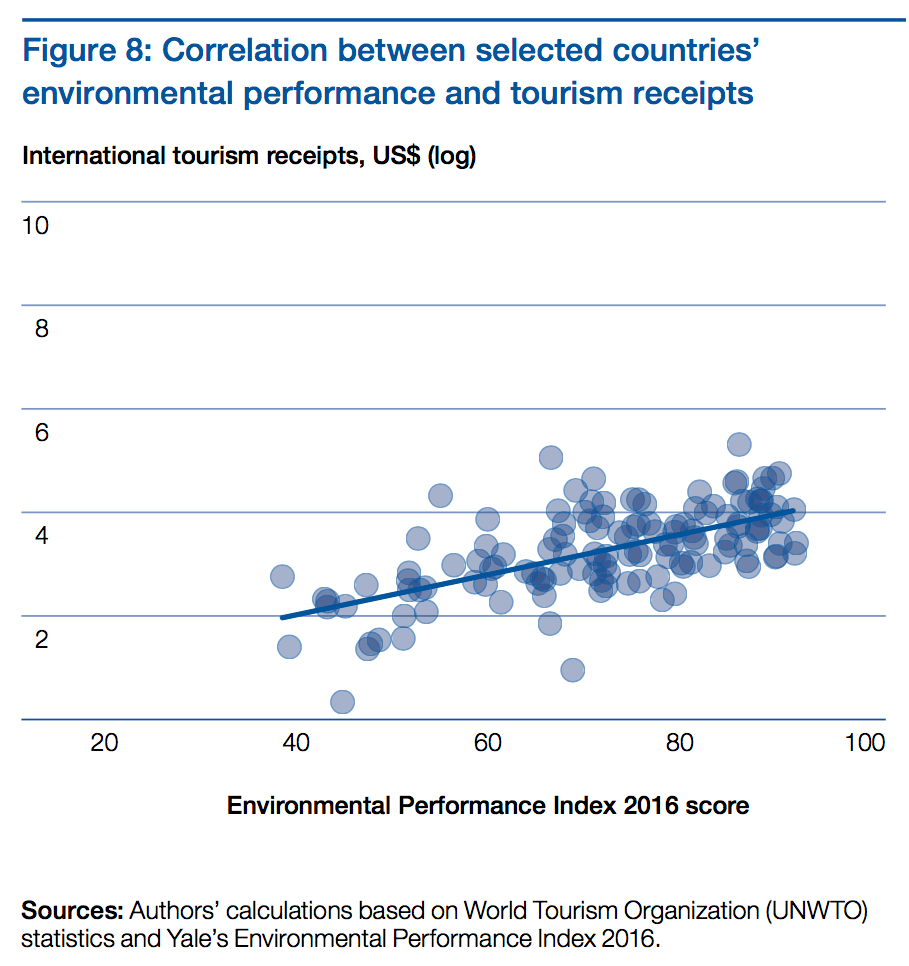

Data reveals that the environmental strength of a country is directly related to tourism revenue. Although this relationship is complex, and there is no evidence of direct causality, the more pristine the natural environment of a country, the more tourists are inclined to travel there, and the more they are willing to pay to access well-preserved areas. Consequently, as the natural capital depletes, destinations lose revenue. Given the close relationship between natural resources and a very large segment of the tourism industry, then, a lack of progress on fostering sustainability, both from a general and sectoral point of view, will reduce tourism development opportunities.

So, how did Kenya do on the T&T rating scale? Sub-Saharan Africa showcases South Africa (53rd), Mauritius (55th), Kenya (80th) and Namibia (82nd) as its four most T&T competitive economies. Despite sustained economic growth, T&T remains mostly untapped. Air connectivity and travel costs remain challenges as well as visa policies and infrastructure. While tourism in the region is mainly driven by natural tourism, there is significant room for improvement in protecting, valuing and communicating cultural richness.

Sub-Saharan Africa remains, on aggregate, the region where Travel & Tourism competitiveness is the least developed. Although regional performance has increased, it has improved less compared to other parts of the world. Southern Africa remains the strongest sub-region, followed by Eastern Africa and then Western Africa. Yet, on average, Eastern Africa is the most improved region, while Southern Africa has experienced a slight decline.

Considering the size and the rich cultural and natural resources, the 29 million tourists visiting the continent in 2015 is low. From a business perspective, the untapped potential of the region could be an opportunity with expected returns potentially higher than other already mature destinations.

Still, a number of conditions need to be in place to grow tourism, including the expansion of an African middle class. Despite sustained economic growth in the past decade, Africa has not seen the same kind of income increases enjoyed by Asian households. As a consequence, only a fraction of African people can afford to travel. While tourism in Europe and, more recently, Asia has been re-fueled by intra-regional travel, data reveals that, on average, African tourists spend a tenth of what an overseas tourist would spend.

Air connectivity and travel cost are challenges linked to the regulatory framework. Although most African nations have signed onto the 1988 Yamoussoukro Declaration in an effort to reach a multilateral “open skies” agreement, almost thirty years later, air travel remains inefficient throughout the region. Stifled by concerns about different levels of development, protectionist fears linked to their national carriers, conflicts with competition regulations and lack of dispute settlement mechanism, mean that, to date, it is still difficult for any company to y to new destinations. Airlines regularly need to lobby their governments to negotiate a bilateral treaty with the destination country, which can be a lengthy process. As a result, there is little competition and little connectivity. In fact, in some cases, it is faster for a passenger to go through Europe rather than use an African hub.The lack of competition in turn impacts the costs of tickets and airport and landing charges. Twenty of the 30 Sub-Saharan countries covered by the Report apply ticket taxes and airport charges above the world average.

The countries that have been more active in signing bilateral agreements—Ethiopia, Kenya and South Africa—have been able to create strong state-owned carriers. Some countries in West Africa rely on privately owned companies, while all other African countries still maintain unpro table, inefficient and insecure publicly-owned national companies. Recently, the ve countries with strong national carriers, private operators and small state-owned operators committed to a Single African Air Transport Market that should enter into force by the end of 2017. Air transport in particular, and transport infrastructure generally, remain, to date, the biggest challenges for travel & tourism development in Africa.

The lack in significant improvement in the use of natural resources is also hindering Africa’s T&T competitiveness. While tourism in the region is mainly driven by natural tourism, there is ample room for improvement in protecting, valuing and communicating cultural richness. In several African countries, there are numerous cultural sites and intangible expressions that could be better leveraged and combined with the rich natural capital available; only South Africa performs above the world average. Natural resources are also unevenly protected, despite the importance of protecting the environment for African economies. On average, environmental performance is positive, but deforestation and habitat loss are becoming problematic in some countries. Ten African countries have lost at least 7% of their forests compared to 2000.

A forest being burnt in the Mara for charcoal production.

The industry’s ability to continue generating growth, creating jobs and enabling national development and regional integration is dependent on whether it recognizes and adapts to key trends and transformational issues that will affect the industry in the short, medium and long term. In terms of sustainability, it’s a must.

A key issue facing MEP is sustainability. The organization’s overall goal is to achieve a viable and sustainable population of elephants in the Mara, helping to secure the long-term socio-economic future of the region and tourism revenues for the nation. It is the ambition of MEP that key government agencies such as the Kenya Wildlife Service (KWS) will not only be supportive of MEP’s activities in areas like security and collaring, but will, in time, and as a result of the impact achievements, provide advocacy and on-going partnering with MEP, not only with activities within the geographic areas of operation but also into the core activities of KWS itself.

MEP is acutely aware that it does not possess all of the necessary resources and competencies to achieve our outcomes. Partnering with camps in the Mara, which forms a large part of this strategy, is an essential element to sustain the change sought. We must have a shared understanding of the benefits of achieving sustainability.

The Travel & Tourism Competitiveness Report is published on a biennial basis, providing a platform for dialogue between the business community and national policymakers working together to improve the T&T competitiveness of their respective economies—and, ultimately, improving prosperity of their citizens.